Midlife Money Transformation – Mastering the mindset of wealth

Mastering the mindset of wealth is about much more than accumulating money—it’s about cultivating a positive, empowered relationship with your finances and unlocking the abundance that surrounds you. Your beliefs, habits, and attitudes toward money shape not only your financial future but also your overall sense of freedom and security. For women over 40, this journey is especially transformative, offering the chance to rewrite old narratives, embrace new opportunities, and align your financial goals with your personal values. By shifting your mindset to one of abundance and possibility, you can create a wealth-conscious life that supports your dreams and empowers your next chapter.

What is a Money Mindset and why does it matter?

Having a money mindset matters because it influences how you perceive, manage, and grow your financial resources. Your mindset shapes your beliefs about money, whether you view it as a tool for freedom and opportunity or as a source of stress and limitation. A positive money mindset helps you make confident decisions, take calculated risks, and overcome financial challenges with resilience.

For women over 40, it’s especially important, as this stage of life often brings unique financial transitions, such as planning for retirement, managing unexpected expenses, or pursuing new ventures. By adopting a healthy money mindset, you can break free from limiting beliefs, embrace abundance, and create a foundation for long-term financial security and fulfillment.

If you rated your relationship with money from 1-10 right now, what would it be? If you were married to money would it be harmonious, loving and abundant or sparse, cold and distant? If money were a person what role would it play in your life?

These are questions I have been asking myself over the last few years. Once I appreciated that EVERYTHING we do involves money, I woke up to the fact that it is actually one of the biggest relationships of our lives! Think about it, you can’t walk out your front door without it, we need it for food, shelter, socialising, grabbing a coffee, clothing ourselves…all of it!

Our life decisions really shape how we end up financially in our 40’s and beyond, we have all led our own financial path and been driven by underlying belief systems that have either served us or not. Understanding and uncovering those deep rooted beliefs is one of the first steps to shining a light on your current financial situation. Many of these beliefs sadly were handed down to us by our parents and the economic times we grew up in.

I will include a great exercise below that I did a few years ago by Slade Roberson, this will support you in delving deeper into those beliefs and re-writing your story.

Let’s look into how we can understand some of the beliefs and stories we tell ourselves about money that could be keeping our bank accounts empty.

What are your core beliefs holding you back from abundance?

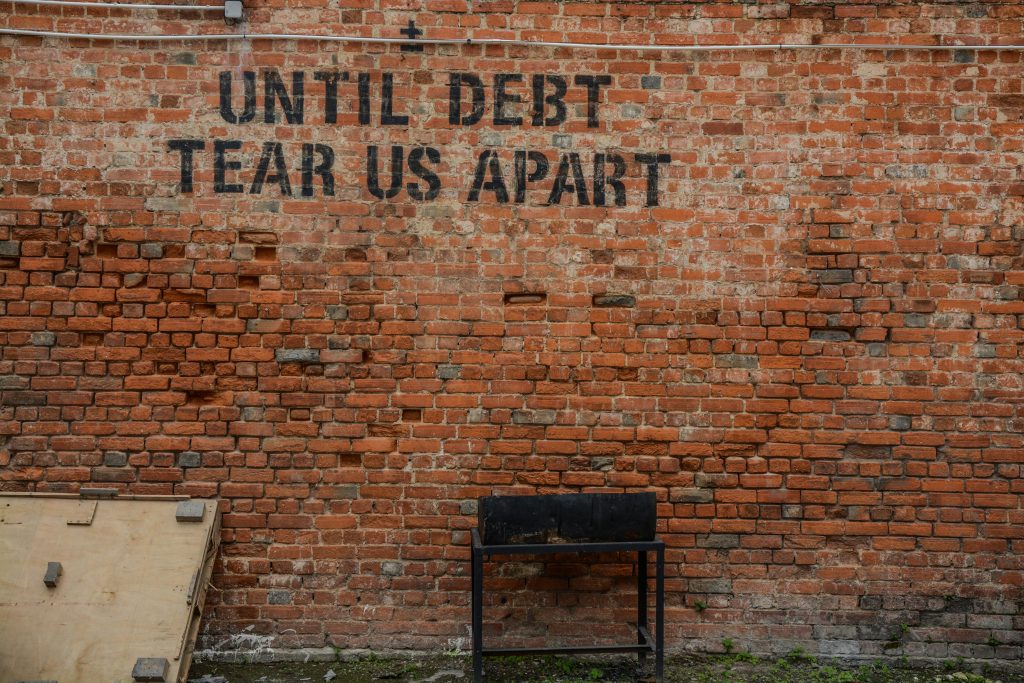

How we think holds so much more power over our earning potential and bank account than we could ever imagine. Most of us are ferrari’s driving with the breaks on, never understanding why we keep spinning the wheels every month and getting into debt. There are of course the practical elements of sensible money habits like not over spending and creating a budget, that’s for another post.

For now let’s stick to money mindset and wealth. I have recently been reading a book called You are a Badass at Making Money and this is the best explanation I have ever come across from Jen Sincero……your beliefs are driving the bus, your thoughts are the tour guide, your words are the assistant to your thoughts, your emotions are the fuel, your actions build the road.

Let me get you started and share some of my own old money beliefs and stories that were graciously handed down to me!

- Loving money is greedy and self-absorbed

- Money causes fights

- Making money means there is no time for the people you love

- Having money would make mum feel bad and less than me

- People with money are stuck up and look down on people

- Money is always out of reach, there is never enough

- If I get rich I will be seen as a show off

- You have to work really hard to earn good money and be wealthy

- Struggling is more noble than succeeding

- Money isn’t important, people are

I really woke up when I realised all the above, how an earth can money come to me when I don’t love money! How can something be drawn to me when I repel it with my avoidance, fear and lack of love, it’s just ENERGY! How can it trust me when I don’t look after it and manage it well, it can’t feel safe and held and respected.

Supercharging your beliefs and mindset for success and abundance

Installing a new money mindset

So how do you counteract all those deep rooted beliefs that have been with you for years? It’s not easy but it is doable with commitment, desire and repetition along with some healthy new money habits. Let’s take a look at how I began to replace the above negative programming….

- Loving money brings me the freedom to support myself and others

- People cause fights, not money, money loves me, money is neutral

- Making money gives me the personal freedom to spend beautiful moments full of joy with the people I most love

- My wealth would bring joy and happiness to mum

- I am a down to earth, generous soul who does great things with my wealth to contribute to humanity

- Money is available everywhere, I love money and it comes to me easily

- I am worthy of all the abundance that life has to offer, I was born abundant

WHAT YOU FOCUS ON YOU CREATE MORE OF!

Five positive words to describe money: Pick your five, here are mine.

Secure

Abundant

Generous

Neutral

Exciting

One of the tools that has really supported me in shifting my money mindset is Joe Dispensa and I listen to this talk/meditation daily as REPETITION is critical to shift stubborn outdated beliefs that no longer serve us. Joe has been a huge influence on my life over the years and most recently in my money mindset shift.

Top tips on shifting your money mindset today

- Begin to explore your relationship with money by looking at your current financial situation, is it thriving and abundant? What feelings do you have around looking at your bank account? How do you behave with money, do you have any bad habits like over spending, impulsive purchases, not budgeting, going into your overdraft every month? Do you bury your head in the sand and put things on your credit card?

- Once you’ve got honest with your current relationship with money start to uncover some of the beliefs that underpin those behaviours. Use the resources and exercises below to help you navigate through your belief systems and understand how and why you may be in the position you are in.

- Make a decision to prioritise your financial health TODAY and build a vision of a future of how it could look to be financially free. Imagine being, doing and having everything you desire. I highly recommend reading You Are A Badass At Making Money by Jen Sincero, this has amazing exercises in every chapter that will guide you through all of the above.

- Start ONE THING today that will begin to transform your money habits and make the biggest impact. I was always going into my overdraft and putting holidays on my credit card. One rule I made for myself was if I haven’t saved for it and it’s not in the bank, I can’t spend it, this meant no holidays last year but a big fat tick for building my respect for money.

- Start to educate yourself on money and how the financial system works, this builds confidence and knowledge giving you the power to make smart decisions for your future. There are hundreds of books and YouTube videos, I will link some below that have changed my life.

Handpicked Support for Your Midlife Journey:

Some of the links below may be affiliate links in the future. I only ever recommend products and resources I truly believe in.

As an Amazon Associate I earn from qualifying purchases.

📚 Books I Love for This Topic

Think & Grow Rich by Napolion Hill

You Are A Badass At Making Money by Jen Sincero

The Compound Effect by Darren Hardy

I Will Teach You To Be Rich by Ramit Sethi

📝 Journal Prompts & Reflection Ideas

Slade Roberson Money Shift exercise. Please note this is an old document and the links no longer work but it has all the right principles and foundations. With regards to the meditation I would go onto YouTube and find a high frequency money meditation, I like the one below and listen as I fall asleep which is the best time to reach your subconscious mind.

🎥 Helpful Videos to Deepen Your Understanding

Conclusion: If my future self could have told me…

- SAVE, SAVE, SAVE and invest for your future, make smart choices and let it compound over time.

- Educate yourself on money, learn about investing, how to budget and manage money wisely.

- Balance spending and joy with investing, think about your future self and build a 6 month emergency fund.

- Learn about building wealth and wealth consciousness and create a positive relationship with money.

- Let go of all your old stories and beliefs about lack that you picked up from family and learn to feel into abundance and a growth mindset.

- Surround yourself with people who have wealth and can model positive behaviour around money.

- Know your value and never settle for being underpaid.