I Am Struggling Financially What Can I Do? Taking Control Of Your Financial Health

Why Do Women Struggle Financially As They Get Older?

I am struggling financially what can I do? I hear this so often at the moment, especially in my circle of female friends who are aged 40 and above. It’s a daunting prospect when you reach your 40’s and 50’s and realize that you aren’t in a financial position that brings you freedom, security and happiness along with a glowing retirement fund. You know the feeling……the one where your stomach sinks and you avoid looking at your bank account because you have yet again gone into your overdraft, or you look at your depleted savings fund in panic.

I was so focused in the moment in my 20’s and 30’s, building my career and spending the money I earnt to live life to the full in London and travel the world. I had all the energy, drive and youth on my side to secure any position I went for and demand a higher salary. It’s amazing how quickly life creeps up on you and suddenly I was in my late 40’s sitting with the stark realization that my team members were all in their 20’s and I was in an industry that promotes churn and burn.

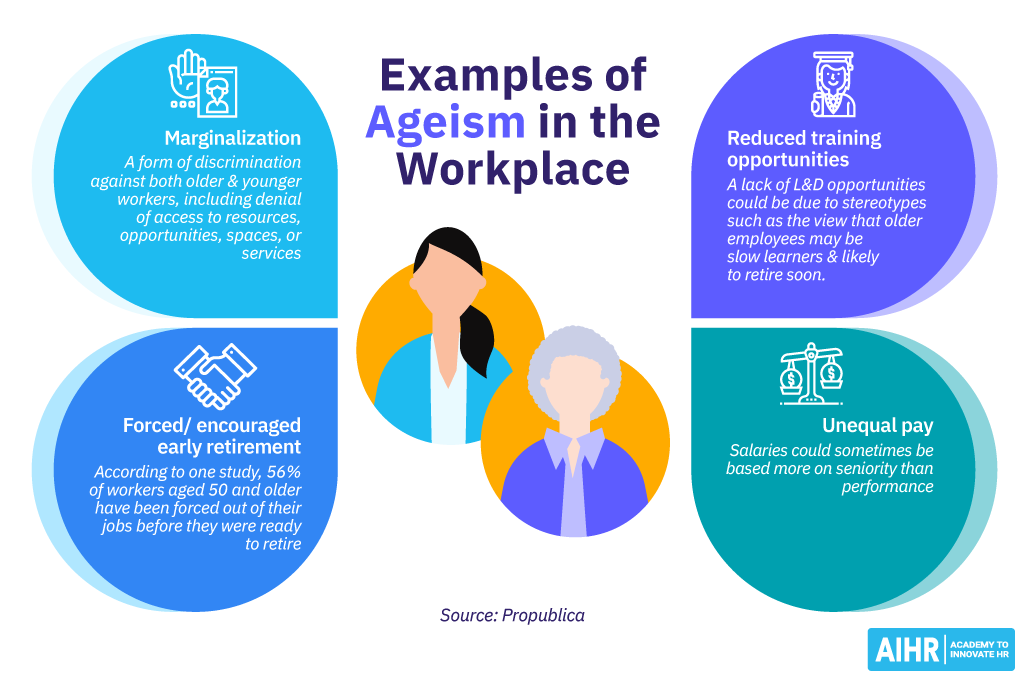

We live in a world where the workplace often marginalizes older women, treating experience as a liability rather than an asset. Despite years of expertise, dedication, and skill, we face ageism and gender bias that limit our career progression, pay, and opportunities. Many of us are overlooked for promotions, sidelined in favor of younger colleagues, or forced into early retirement. This systemic discrimination not only devalues our contributions but also exacerbates financial insecurity, leaving us struggling at a time when stability should be within reach.

Key Questions to Ask About Your Financial Situation & Security as You Age

So what do you do if you are now in a position with your best “corporate” years behind you, and in an ageist workplace with fewer opportunities to build financial stability for your future? Is your pension fund enough to retire on and do you even want to retire?! I’ve been seriously reflecting on these questions and they have kept me up at night.

I have also come to appreciate that I am far from ready to retire and that my most rewarding, successful and abundant years are ahead of me! So let’s start with a basic financial health check before we move into your next best steps……

1. Current Financial Health

- What are my total savings, investments, and assets?

- Do I have any outstanding debts (mortgage, loans, credit cards)?

- Am I tracking my income and expenses effectively?

Take your time with this and don’t panic or let it get you down if you’re not where you need to be. This post is about the nitty gritty of managing your finances but I have other posts on Money Mindset and your relationship with money that will lift your spirits and inspire you to start a fresh.

When I was running my own financial health check (I refuse to use the word budgeting as it sits in lack) I used this finance planning spreadsheet from Money Saving Expert.

2. Retirement Planning

- How much do I need to retire to live my best life?

So this is a really critical question and note “BEST LIFE’! In this second chapter of our lives we deserve to be living abundantly, free to be, have and do the things that bring us joy. Strip away all limitations here, taking the cap off that imagined glass ceiling and dream big! This post on becoming your future self now may support you with this.

- Am I on track with my pension contributions (State Pension, workplace pension, personal pension)?

- Have I checked my National Insurance contributions to ensure I qualify for a full State Pension?

- Do I have additional retirement savings, such as ISAs or other investments?

3. Income Sources in Later Life

- What will be my main sources of income after retirement (pension, investments, rental income, part-time work)?

It’s really important here to evaluate the cost of living for your best life and understand if the above will be enough to support that. The vision you have for your future will drive actions and wise decisions financially that are in alignment with that future lifestyle. I will do other posts on securing extra income.

- Will I need to work beyond retirement age, and if so, in what capacity?

- How can I diversify my income to avoid reliance on a single source?

4. Cost of Living & Inflation

- Have I factored inflation into my long-term financial planning?

- Will my current lifestyle be affordable in retirement, or will I need to downsize or adjust spending?

5. Healthcare & Long-Term Care

- How will I cover healthcare expenses as I age?

- Do I have a plan for long-term care costs, such as home care or nursing home expenses?

- Should I consider long-term care insurance or build a separate fund for care needs?

- Consulting a financial advisor experienced in LTC planning can provide personalized strategies. Several UK firms offer such services:

- Unividual: Offers tailored advice on saving for long-term care, emphasizing the importance of early planning. unividual.co.uk

- Financial Advice Services (FAS): Assists with long-term care planning to alleviate the stress associated with future care costs. financial-advice.co.uk

- Milestone Financial Planning Advisors: Helps identify the best options for long-term care planning and assesses eligibility for funding. milestonefp.co.uk

- Hargreaves Lansdown: Provides long-term care planning services, with advisors accredited by the Society of Later Life Advisers (SOLLA). hl.co.uk

6. Estate Planning & Protection

- Do I have a will and an updated estate plan?

- Have I appointed a power of attorney in case I become unable to manage my finances?

- Are my beneficiaries correctly designated on all my financial accounts and insurance policies?

7. Financial Literacy & Support

- Am I confident in managing my own finances, or do I need professional advice?

This was a big one for me, I was in the process of remortgaging and I would have normally done the switch online myself. For some reason it wouldn’t allow me too so I ended up consulting with a mortgage advisor who managed to secure a great rate. In addition to that I got further advice financially which really supported my financial health.

I would highly recommend Kate at Gaia Financial based in Worthing, UK. Mortgage brokers do charge a fee but in the long run can save you money and gain access to the best deals on the market. Kate is also one of the only specialists in the UK that deals with Equity Release.

- Do I have a trusted financial advisor or support system to help with major financial decisions?

- How can I continue learning about investments, tax planning, and financial security?

There are so many courses and books out there on everything you could ever want to learn! Investing in your future financial health and empowering yourself to become knowledgeable will give you all the confidence you need to make wise decisions.

Final Thoughts

I’ve personally been on a feast or famine journey with my relationship to money and my financial security. As we age as women and become more vulnerable to external factors like ageism in the workplace, we really need to power up on our own internal resources. Whatever situation you are in know it can change, with both shifts in day to day money habits and money mindset, we can turn our lives around financially bit by bit.

In future posts I will cover what money habits I installed that really started me on a path of financial wellness, what I still struggle with and what tactics and tools I use to keep me on track.

Handpicked Support for Your Midlife Journey:

Some of the links below may be affiliate links in the future. I only ever recommend products and resources I truly believe in.

📝 Journal Prompts & Reflection Ideas

3/ Restless job site for age diverse employers – mainly UK based

4/ Noon job site for employers actively or happily looking for older candidates – mainly UK based

5/ Working nomads for fully remote jobs, not necessarily age diverse but a great site if you want to travel and live abroad and create a new lifestyle! I will do other posts on utilising your current skill sets and linking to your passions to create an amazing new vocation.

Disclaimer:

The information provided in this blog post is for informational and educational purposes only and should not be considered financial, legal, or professional advice. While we strive to provide accurate and up-to-date information, we do not guarantee the completeness, reliability, or suitability of any resources, links, or advice mentioned.

Any financial decisions made based on this content are at your own risk. We strongly recommend consulting with a qualified financial advisor before making any investment, savings, or financial planning decisions.

Additionally, external links provided in this post are for reference only. We do not endorse or take responsibility for the accuracy, security, or content of third-party websites. Use them at your discretion.

By using this blog and its resources, you acknowledge and agree that the author(s) and website owner(s) are not liable for any losses, damages, or financial outcomes resulting from the use of the information provided.

Conclusion: If my future self could have told me…

- Financial Health is real, it’s a huge part of your overall wellness and mirrors so much more about your worth and value than you think.

- Always track 10 years ahead and keep your future financial health in mind. If I spend this today how will that impact my future self and well being.

- Instant gratification may feel good in the moment but your future self won’t thank you for it if you haven’t secured your financial future.

- Money is energy and one of the biggest relationships you will have in your life. If you don’t honour and respect it, it won’t respect you or come into your life.

- Money management is part of life, burying your head in the sand or not enjoying taking care of it will only lead to poverty and lack.

- Empower yourself NOW, invest, save and be smart. Investments aren’t there as a back up spending pot. Think of your long-term wealth as a money tree, if you keep picking at the leaves it will soon be depleted.